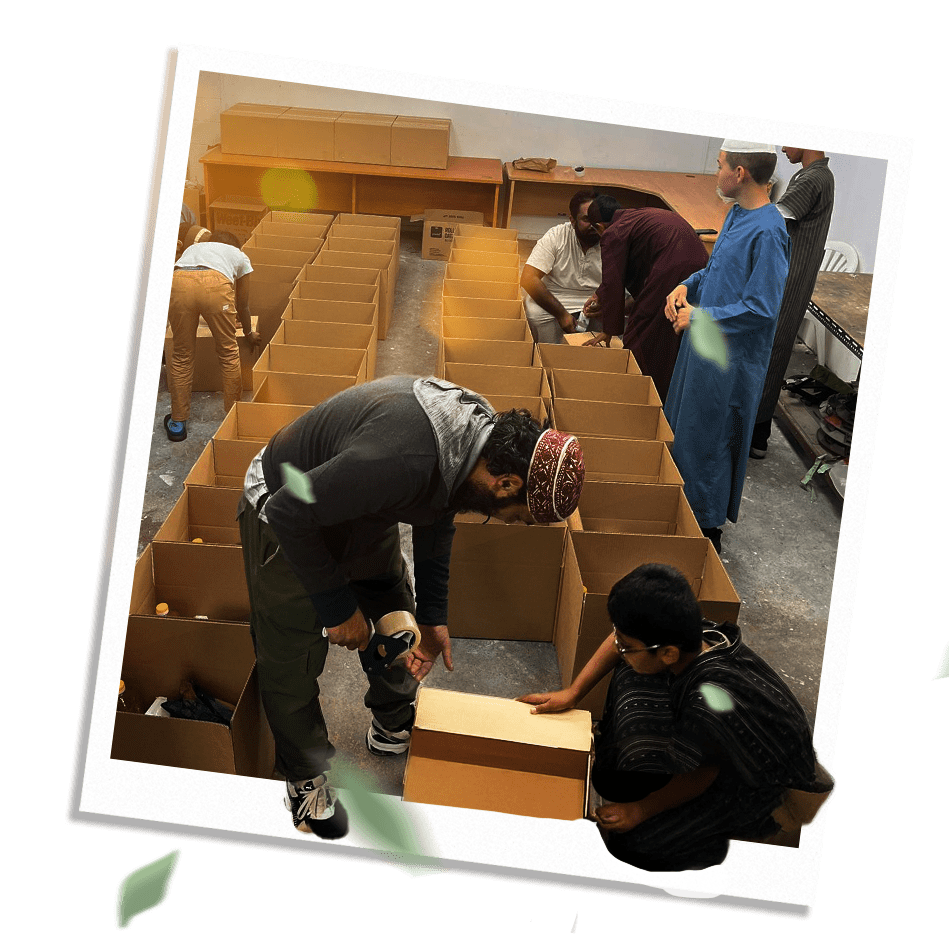

Empower the needy with your Zakat

This Ramadan, your Zakat can make a world of difference for vulnerable Muslims in New Zealand.

We’re committed to facilitating the collection and distribution of Zakat to those in need, helping our community rise out of financial hardship and thrive.

Know how much you owe? Pay Now

What is Zakat and why does it matter?

A Divine Obligation

Interactive Zakat Calculator

Zakat isn’t just about giving – it’s about giving accurately. Many Muslims unintentionally underpay or overpay their Zakat simply because the calculation is unclear.

That’s why we offer a simple, step-by-step calculator – to help you work out your Zakat correctly, confidently, and in line with Islamic requirements. It covers all relevant assets – cash, gold, shares, business assets, and more – and instantly shows you how much you owe.

Your Zakat is a right of the poor. Calculating it properly ensures your obligation is fulfilled and that your wealth is truly purified.

– Exciting, New Calculator Launching Soon! –

Your Zakat is a

transformative gift

Single parents

struggling to make ends meet

Survivors of domestic violence

who are working hard to rebuild their lives

New Muslims

burdened with interest-bearing debt incurred before embracing Islam

Why Trust Zakat Foundation with your Zakat?

Shariah-Compliant Distribution

Our Zakat is managed under qualified scholarly guidance, ensuring your obligation is fulfilled exactly as prescribed in Islam.

100% Zakat Donation Policy

Every dollar of your Zakat is used strictly for eligible recipients – nothing is deducted for admin or overheads.

Supporting Muslims in Aotearoa

Your Zakat reaches those struggling right here in New Zealand, helping to strengthen and uplift our local Muslim community.

Pay your Zakat

Now that you’ve calculated your Zakat, it’s time to fulfil your obligation.

Whether you’re giving Zakat al-Mal or Zakat al-Fitr, we’ve made the process simple and secure.

Just choose the appropriate option, complete your payment, and we’ll ensure your Zakat is distributed correctly, in line with Islamic principles.

Zakat al Mal

2.5% of wealth, due annually

Zakat al Fitr

$15 per family member, due before Eid

Zakat is a debt: Use the calculator to find out how much you owe and avoid underpaying

Your Zakat Questions, answered

Is it better to give my Zakat in New Zealand or overseas?

Both are valid. However, the majority of scholars recommend giving Zakat locally when there is a clear need. In New Zealand, many Muslims are silently struggling with housing, debt, and basic living costs. Supporting them helps strengthen the community closest to you.

What’s the difference between Zakat al-Mal and Zakat al-Fitr?

Zakat al-Mal is the annual Zakat due on your wealth savings, gold, shares, etc.). It is calculated at 2.5%

Zakat al-Fitr is a fixed amount per person, due before Eid al-Fitr, and is usually paid in the last days of Ramadan.

How do I know if I’m eligible to pay Zakat?

You are required to pay Zakat if:

- You’re a Muslim adult who is sane and free,

- You’ve owned wealth above the nisab threshold for one full lunar year.

Our calculator helps determine if you’re above the nisab.

Can I pay Zakat in instalments or set up a regular payment?

Yes. While Zakat should be paid as soon as it’s due, you can set up automated giving throughout the year to help plan your payment. Just ensure the full amount is paid by your due date.

What does NZZF do with my Zakat?

We distribute Zakat strictly to eligible recipients, both locally and globally. We work with trusted scholars, maintain transparency, and ensure your Zakat reaches those who qualify — including individuals facing hardship right here in Aotearoa.

What is Nisab and how is it calculated?

Nisab is the minimum amount of wealth a person must have before they are required to pay Zakat.

It’s equivalent to the value of 87.48g of gold or 612.36g of silver.

You only pay Zakat if your total wealth stays above the nisab for one full lunar year. Our calculator uses up-to-date values to help you determine this easily.

What types of assets do I need to include in my Zakat calculation?

You should include:

- Cash and savings

- Gold and silver

- Shares and investments

- Business stock or assets

- Money owed to you (that you expect to be repaid)

You can exclude personal items like your home, car, and everyday clothing.

Can I give my Zakat to family members?

Yes – but only if they are eligible (i.e., poor or in need) and not directly dependent on you.

You can’t give Zakat to your parents, children, or spouse. But you can give it to siblings, uncles, aunts, or cousins if they qualify.

What if I forgot to pay Zakat in previous years?

You are still obligated to pay it. Calculate the missed amount as accurately as you can, even if you need to estimate. Intention and effort matter, and it’s better to catch up than ignore it.

Copyright 2025 Lote Tree Trust. All Rights Reserved.